India’s recent GST rationalization marks a significant step forward for the auto industry. It brings much-needed clarity to a complex tax structure. However, clarity alone will not drive the change needed for sustainable growth. The real test lies in leveraging this policy to accelerate cleaner mobility adoption across the nation.

We are at a pivotal moment in India’s development journey. The government has established a cleaner baseline through tax reforms. Aligning fiscal policy with long-term green mobility goals presents both a challenge and an opportunity for progress.

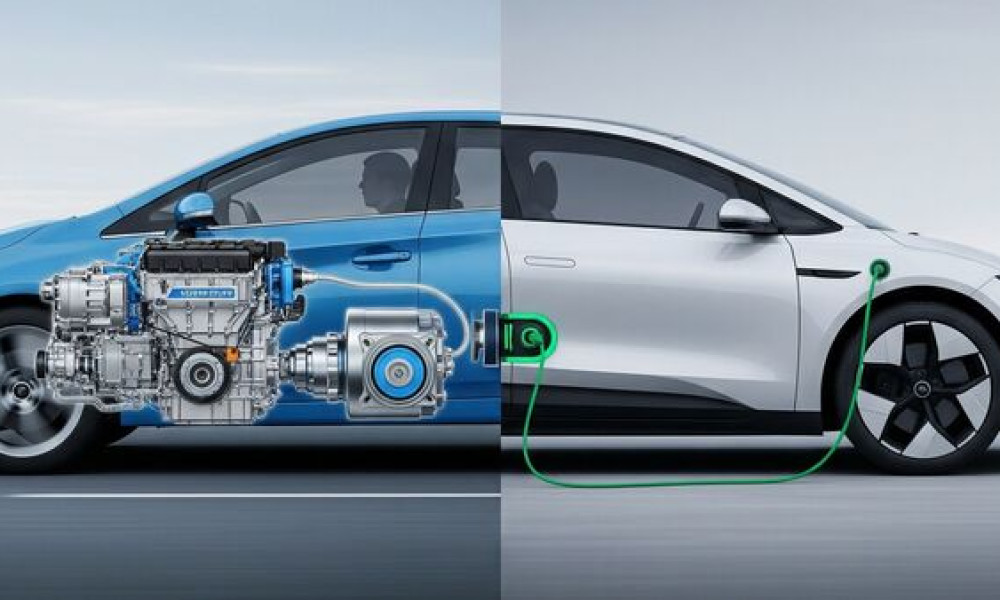

Historically, automotive taxation focused on engine size or fuel type. This approach is outdated in an era shifting toward electric and hybrid vehicles. With EV adoption still low, policy must actively reward cleaner technologies to foster growth.

GST rationalization removes structural clutter effectively. Without targeted incentives for green innovations, this clarity may not achieve its full potential. Taxation should strategically shape India’s mobility future for maximum benefit.

The potential for clean mobility in India is enormous. Electric and flex-fuel vehicles reduce emissions and cut fuel imports. They also boost domestic manufacturing and technological innovation across sectors.

Adoption faces hurdles like high costs and limited infrastructure. Thoughtful policy interventions can overcome these barriers. GST differentiation could make clean vehicles more accessible and appealing to consumers.

A tiered GST structure would send powerful market signals. Zero rates for battery EVs and low rates for hybrids would highlight national priorities. This approach values sustainability over conventional auto sector practices.

Policy stability is crucial for building self-reliance in green mobility. The auto sector needs certainty to invest in charging networks and supply chains. A ten-year horizon for GST policy would enable meaningful scaling of domestic capabilities.

Once clean-tech reaches 20-25% penetration, adjustments can be made. The ecological advantages between technologies must remain clear. Ambiguity could stall momentum before achieving significant scale.

Some argue market forces alone can drive adoption. While rate simplification helps, its benefits are uneven across the industry. Stranded tax credits create financial friction for businesses.

Interpretational ambiguities may discourage manufacturers from passing benefits to consumers. Relying solely on market dynamics risks leaving India behind in the global clean mobility race.

This is about more than economics. Environmental stewardship and strategic independence are at stake. Urban air quality and high oil imports demand urgent policy action.

Every policy choice today shapes India’s next decade. GST rates can align incentives for consumers, industry, and investors. They can make clean vehicles desirable while reinforcing sustainability commitments.

India must treat GST as a strategic instrument for mobility transformation. Current reforms are welcome, but the next steps must support long-term green vision through clear incentives and infrastructure development.

Widespread adoption requires robust domestic supply chains and skills. Policy should make clean mobility the default choice rather than a niche option. India can show leadership by prioritizing environment, industry, and consumers simultaneously.

The foundation is laid for progress. Policymakers and industry must now ensure India’s roads feature cleaner, smarter vehicles for a sustainable future.