Great news for borrowers is on the horizon. The Reserve Bank of India has just made a significant move to lighten the load for millions. Home, auto, and business loans are poised to become more affordable very soon.

This change comes as the RBI cut its key benchmark interest rate for the first time in six months. The central bank’s decision is a direct response to support the economy during a challenging period. It aims to counter the impact of high US tariffs on Indian goods.

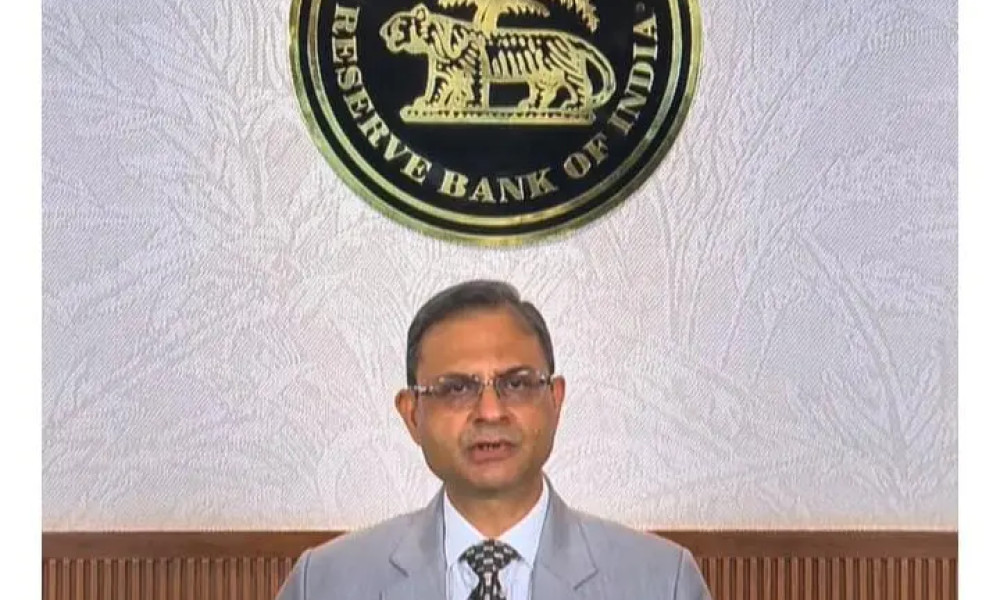

The six-member monetary policy committee voted unanimously for this cut. Led by Governor Sanjay Malhotra, they lowered the repo rate by 25 basis points to 5.25 percent. The committee also retained a neutral stance, leaving the door open for future action.

The timing of this RBI move is crucial. The Indian economy has been facing headwinds from external trade pressures. A steep 50 percent tariff imposed by the US has already hurt exports and weakened the rupee.

This rate cut is designed to lend support where it’s needed most. It will work alongside recent government reforms like GST changes and relaxed regulations. Together, these efforts aim to bolster economic resilience.

So, how does this RBI decision translate to your wallet? A lower repo rate reduces the cost for banks to borrow from the central bank. This cheaper funding trickles down to consumers and businesses through lower lending rates.

Expect to see reductions in MCLR and base rates from banks. This directly makes home loans and auto loans more affordable for individuals. For businesses, it means cheaper capital to invest and grow.

The immediate benefit is a potential reduction in your EMIs. Lower monthly payments can encourage more people to take out loans. This increased borrowing supports wider economic activity and spending.

But the RBI didn’t stop at just cutting rates. It also announced a massive liquidity boost of Rs 1 lakh crore for the banking sector. This will be injected through open market purchases of government bonds in two tranches.

Additionally, a USD 5 billion buy-sell forex swap is scheduled. Both measures are timed to address seasonal liquidity pressures banks face. They ensure the system has ample cash to transmit the lower rates effectively.

Governor Malhotra described the current economic phase as a ‘goldilocks’ period. This rare scenario combines benign inflation at 2.2 percent with strong growth at 8.0 percent for the first half of the fiscal year. It creates ideal conditions for supportive policy.

The central bank has revised its forecasts based on this positive outlook. It lowered the inflation projection for the fiscal year to 2 percent from 2.6 percent. Simultaneously, it raised the GDP growth estimate to 7.3 percent from 6.8 percent.

Malhotra emphasized that the growth-inflation balance provides policy space. The benign outlook for both headline and core inflation allows the RBI to remain growth-supportive. This is vital despite an unfavourable external environment.

Economists have welcomed the RBI’s growth-supportive stance. Crisil’s Dharmakirti Joshi noted the decision underscores a focus on bolstering the economy. He pointed to surprising economic data that created room for this move.

Real GDP growth hit 8 percent in the first half of this fiscal, exceeding expectations. Retail inflation has decelerated sharply during the same period. This combination gave the central bank the necessary elbow room to act.

The drop in inflation below the RBI’s target range is largely driven by food prices. Fuel inflation has also remained subdued, contributing to the overall calm. Core inflation, excluding volatile items, was a modest 2.6 percent in October.

This low core inflation indicates an absence of excess demand pressure in the economy. Factors like GST cuts and global excess supply capacity, especially from China, are helping. These elements suggest limited upward pressure on goods inflation for now.

Experts note that the full effect of this repo rate cut will unfold over time. Monetary policy typically operates with a lag, meaning the growth support will be more visible next fiscal year. The immediate boost in liquidity, however, should speed up the transmission.

There are considerations on the currency front as well. Anitha Rangan of RBL Bank noted the rate cut could pressure the rupee. However, the announced forex swap shows the RBI is cognizant of these potential currency pressures and is acting to manage them.

This marks the fourth rate cut since February 2025, bringing the total reduction to 125 basis points. The RBI had held rates steady in its August and October policy meetings. The latest move signals a renewed proactive approach to nurture the economy.

Governor Malhotra reaffirmed the central bank’s commitment to meeting the economy’s productive needs. The RBI will act in a proactive manner while ensuring overall macroeconomic stability remains intact. The goal is to sustain the current growth momentum through supportive measures.