The Insurance Brokers Association of India (IBAI) has unveiled a groundbreaking report predicting massive growth for the country’s insurance sector. Titled ‘Leading the Path to Insurance for All: Broker of the Future’, the report, prepared with McKinsey & Company, forecasts that India’s insurance market could skyrocket from ₹11 lakh crore in 2024 to ₹25 lakh crore by 2030.

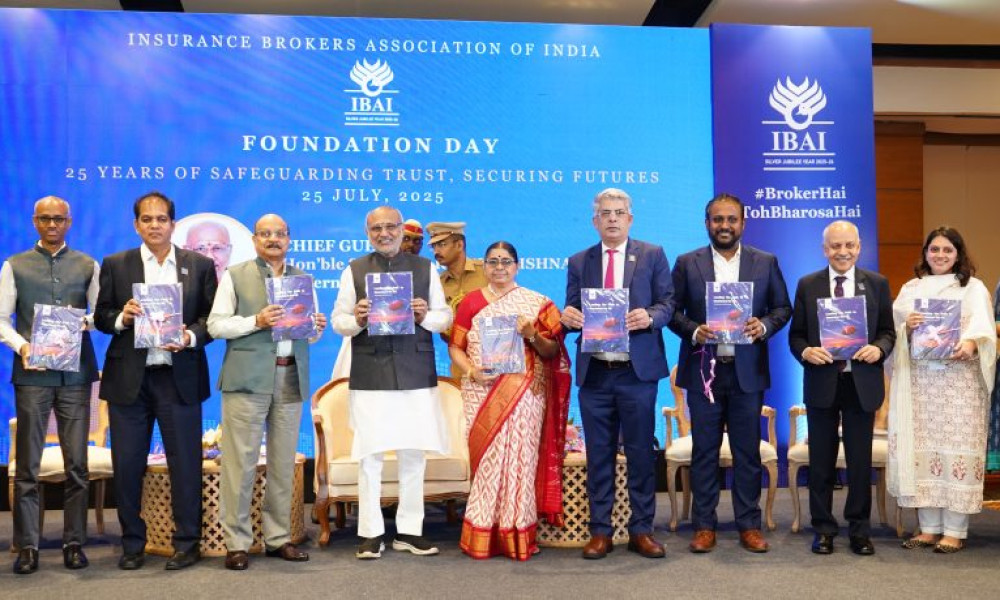

This exciting revelation came during IBAI’s 24th Foundation Day celebrations in Mumbai, attended by Maharashtra Governor C.P. Radhakrishnan and other prominent figures including Finance Ministry officials and insurance industry leaders. The event marked IBAI’s entry into its silver jubilee year, aligning with the government’s vision of ‘Insurance for All by 2047’.

Current statistics paint an interesting picture. While 60% of affluent Indians believe their life insurance should cover 10 times their salary, only 30% actually have this level of protection. The report highlights that trust plays a crucial role in insurance decisions, with 70% of wealthy customers relying on trusted advisors and 45% of mass-market buyers following friends’ recommendations.

The claims process emerges as a critical factor in customer satisfaction. Half of high-net-worth individuals considered switching insurers after poor claims experiences, while over 55% of SMEs faced claim rejections, with 75% needing help with documentation.

India faces a staggering 91% protection gap, one of the highest globally. Despite being the world’s fourth largest economy, insurance penetration stands at just 3.7%, far below the 6.8% global average. The rural-urban divide is particularly striking, with rural areas contributing 45% of GDP but housing only 2% of life insurance branches.

The report identifies retail and SME segments as key growth drivers. Retail premiums could double to ₹21 lakh crore by 2030, with the mass market contributing 45% despite price sensitivity. SME insurance could grow 4-5 times, though currently less than 5% of India’s 6 crore SMEs have any coverage.

Insurance brokers currently number just 735 in India, with the top 36 handling 85% of business. The sector shows room for growth, as only 35% of global brokers operate in India compared to 60% of top insurers. Limited access to capital restricts brokers’ ability to invest in technology and expansion.

Finance Ministry Secretary M Nagaraju emphasized brokers’ vital role in achieving ‘Insurance for All’, particularly in smaller cities and rural areas. IBAI President Narendra Bharindwal sees this as a transformative moment for brokers to evolve from intermediaries to trusted advisors.

McKinsey’s Peeyush Dalmia described the industry at an inflection point, requiring innovation across stakeholders. The report suggests four key interventions for brokers: segment-specific engagement, reaching underserved markets, product innovation, and improving after-sales experience.

With insurance penetration potentially rising to 5% by 2030 and the sector poised for massive expansion, India’s insurance landscape appears set for significant transformation. The coming years will test whether brokers and insurers can bridge the substantial protection gap and make coverage accessible to all Indians.