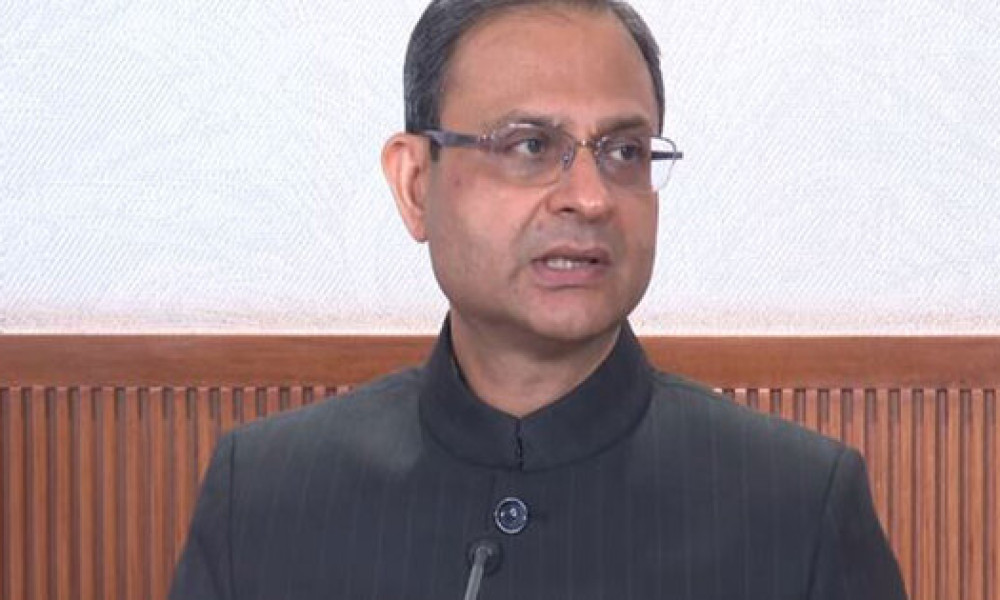

Reserve Bank of India Governor Sanjay Malhotra stated the central bank will examine a recent SEBI proposal. This proposal suggests allowing banks to venture into non-agricultural derivatives. The RBI will study the pros and cons of this significant move.

Governor Malhotra confirmed the proposal arrived just recently. He made these remarks during the post-monetary policy press conference. The issue requires careful regulatory consideration.

A key point is the potential need for legislative change. The current Banking Regulation Act does not permit banks to engage in such products. Therefore, amendments may be necessary to facilitate this foray.

This is not the first time such an idea has surfaced. Similar proposals were studied in the past and deemed inappropriate. The RBI will now assess if circumstances have changed over the last eight to nine years.

Governor Malhotra emphasized the need for thorough analysis. He stated it would be incorrect to give a firm response without studying the details. The central bank’s approach remains cautious and deliberative.

Currently, non-agri derivatives trade on stock and commodity exchanges in India. Allowing banks into this space could reshape the market landscape. The RBI’s study will be crucial for determining the next steps.

The press conference also covered inflation forecasts. The RBI governor affirmed that current rupee levels were factored into their estimates. Their inflation forecast for 2025-26 stands at a low 2 per cent.

He provided insight into currency dynamics. A 5 per cent depreciation of the rupee leads to about 35 basis points of inflation. Conversely, it helps exports and GDP growth by roughly 25 basis points.

On IMF grading, Deputy Governor Poonam Gupta addressed concerns. She clarified the ‘C’ grade for national accounts related to the base year, not data quality. Gupta believes a base year revision will satisfy the IMF on this count.

Regarding exchange rates, Gupta explained India’s policy. She stated India practices a managed float, like most emerging markets. The RBI intervenes to curb undue volatility, maintaining stability.

She elaborated on the IMF’s ‘crawling peg’ sub-classification. This was based on observing contained volatility over six months. Gupta advised not to read too much into this label, emphasizing India’s managed float regime.

Earlier in the day, Governor Malhotra characterized India’s macroeconomic moment. He called it a ‘rare goldilocks period’ marked by high growth and low inflation. This favorable balance informed the latest policy decisions.

The Monetary Policy Committee announced a repo rate cut. They reduced the rate by 25 basis points to 5.25 per cent. This decision followed a three-day review meeting.

Inflation forecasts were revised downward. The CPI inflation forecast for 2025-26 was cut to just 2.0 per cent. This reflects a benign inflationary environment.

Robust economic growth supports this positive outlook. India’s real GDP expanded by 8.2 per cent in Q2 of 2025-26. Strong consumption and GST rationalization fueled this expansion.

Given the growth-inflation balance, the MPC voted unanimously for the rate cut. They also maintained a neutral monetary policy stance. The RBI raised its full-year GDP growth projection to 7.3 per cent.