Home Loans: It’s a Great Time to Borrow

Banks are fighting to offer you the best deals on home loans right now.

Low Starting Price: Some banks are offering home loan interest rates that start as low as 7.35% per year.

Who Gets the Best Deal? These super low rates are mainly for people who have an excellent credit score (a perfect record of paying bills) and a stable job.

The Big Picture: Banks are keen to lend, so it’s a competitive market that is good news for you if you’re looking to buy a house or switch your loan.

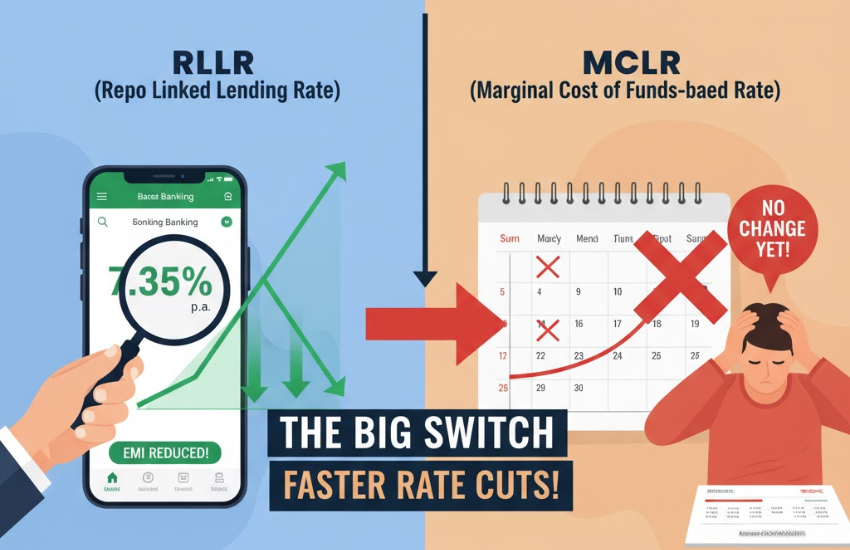

MCLR vs. RLLR: Why Everyone is Switching

When you take out a loan, the interest rate is tied to one of two main formulas (or ‘benchmarks’): MCLR or RLLR.

The central bank recently cut the main lending rate (the Repo Rate). This is where the difference between the two benchmarks really matters:

| Loan Type | How It Works | Why People Choose It Now |

| RLLR (Repo Linked Rate) | The loan rate is directly tied to the central bank’s rate. | Interest cuts happen fast! If the central bank cuts rates, your EMI (monthly payment) goes down almost right away. This is why many borrowers are switching to RLLR. |

| MCLR (Internal Rate) | The loan rate is set by the bank and only changes after a delay (usually every 6 or 12 months). | Interest cuts are slow. Even if the central bank cuts rates, your EMI stays the same until your next loan reset date. Borrowers feel this is unfair when rates are going down. |

The Bottom Line: Many people with older MCLR loans are moving to RLLR because they want the benefit of lower interest rates right now, not six months from now!