India’s massive US$283 billion information technology sector faces a major strategic overhaul. This comes after US President Donald Trump’s move to impose a steep US$100,000 fee for new H-1B visas starting September 21. Tech veterans, analysts, lawyers, and economists all agree this will disrupt long-standing practices. The industry must now rethink its entire approach to US projects.

The sector earns a significant 57 percent of its total revenue from the US market. It has long benefited from US work visa programs and the outsourcing of software and business services. This has been a contentious issue for many Americans who have lost jobs to cheaper workers abroad. The reliance on this model is now under direct threat.

India was by far the largest beneficiary of H-1B visas in 2024. It accounted for a dominant 71 percent of all approved beneficiaries. China was a distant second at just 11.7 percent, according to official US government data. This highlights the profound impact the new policy will have specifically on Indian firms.

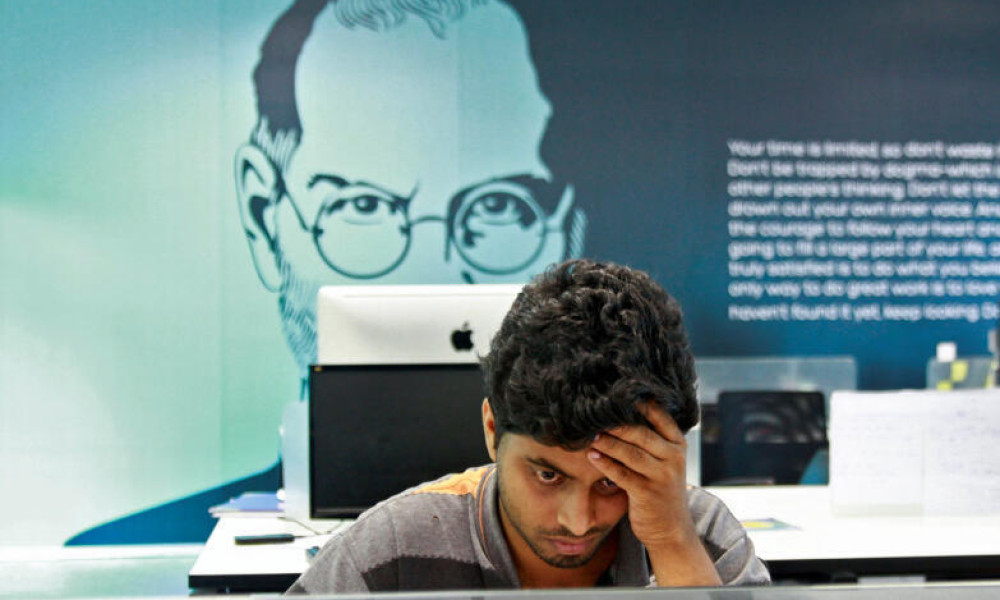

Experts say Trump’s move will force major IT firms to pause onshore rotations. These companies serve giant clients like Apple, JPMorgan Chase, and Microsoft. They will now need to accelerate offshore delivery and ramp up hiring of US citizens and green card holders. The entire operational playbook is being rewritten overnight.

The ‘American Dream’ for aspiring workers will be tough, said former Zensar Technologies CEO Ganesh Natarajan. He expects firms to severely restrict cross-border travel. More work will be done from countries like India, Mexico, and the Philippines. This represents a fundamental shift in how global teams are managed.

Major Indian IT firms like Tata Consultancy Services and Infosys did not comment on the news. Industry body Nasscom warned the move would have ripple effects on America’s own innovation ecosystem. It also stated it would disrupt business continuity for critical onshore projects, creating widespread uncertainty.

Emkay Global Chief Economist Madhavi Arora noted services exports have been dragged into the global trade war. This disruption could severely pressure the IT sector’s onsite-offshore model, hurting margins and straining supply chains. The economic implications extend far beyond visa paperwork.

Most industry watchers expect client-facing roles to be constrained. This will hurt IT deal conversion rates and extend the time needed to scale up tech projects. The direct client impact could lead to delayed revenues and strained relationships, adding another layer of complexity.

HFS Research CEO Phil Fersht provided a clear picture of client reactions. Clients will demand repricing or delay start dates until legal clarity emerges. Some projects will be re-scoped to reduce onshore staffing needs immediately. Others will shift delivery offshore or near-shore right from day one.

Immigration lawyers received frantic calls over the weekend due to the chaos. Trump’s proclamation accused the IT sector of manipulating the H-1B system. Lawyers confirmed the new visa fee is exceptionally steep and will change employer behavior fundamentally.

Vic Goel, managing partner at Goel & Anderson, expects companies to become far more selective. They will reserve H-1B filings for only the most business-critical roles. This would significantly reduce access to the program for many skilled foreign nationals. It will reshape employer demand entirely.

Initial confusion led to panic among workers. Companies like Microsoft and Amazon advised H-1B employees to return to the US before September 21. This forced many workers from India and China to abandon travel plans and rush back, creating personal and professional turmoil.

Many immigration lawyers anticipate swift legal challenges to Trump’s move. We are anticipating that several lawsuits will be immediately forthcoming this week, said Alcorn Immigration Law CEO Sophie Alcorn. The legal battle is just beginning, and the outcome remains highly uncertain.

The visa issue is not the only challenge. The sector also awaits clarity on a proposed 25 percent tax on outsourcing payments. It simultaneously struggles with weak revenue growth in its mainstay US market. Clients are deferring non-essential tech spending due to inflation and tariff uncertainty.

Industry watchers expect this to accelerate the growth of US firms’ global capability centers, or GCCs. These have evolved from low-cost back offices to high-value innovation hubs. They support critical operations, finance, and research and development functions globally.

ISG President Steven Hall notes time zone proximity will boost GCC growth in Canada, Mexico, and Latin America. Talent there is stable and cost advantages remain. GCCs in India will also rise with broader capabilities as enterprises shift strategic roles there, creating new opportunities within the country.

India is already home to over half of the world’s GCCs. A Nasscom-Zinnov report projects it will host more than 2,200 companies by 2030. This market could near US$100 billion in size and generate up to 2.8 million jobs, signaling a potential silver lining.

Constellation Research’s Ray Wang sees a new world order on services economics. He expects more GCCs in India, more local US hiring, and more pressure for automation and AI. The result will be less outsourcing, fewer H-1B visas, and far less job mobility, fundamentally altering the global IT landscape.